All about Hard Money Georgia

Wiki Article

Rumored Buzz on Hard Money Georgia

Table of ContentsExcitement About Hard Money GeorgiaHow Hard Money Georgia can Save You Time, Stress, and Money.The Basic Principles Of Hard Money Georgia The 5-Second Trick For Hard Money Georgia

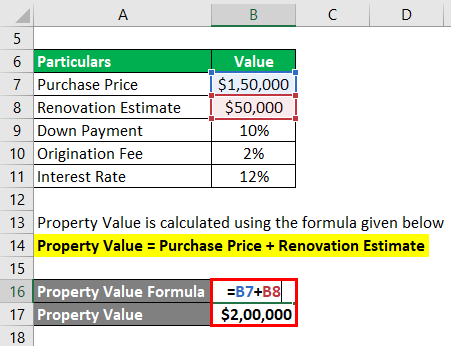

The maximum appropriate LTV for a difficult money lending is generally 65% to 75%. On a $200,000 home, the optimum a difficult cash lending institution would be willing to offer you is $150,000.

By contrast, rate of interest prices on hard money finances begin at 6. 25% but can go much greater based upon your location and the house's LTV. There are various other prices to keep in mind, too. Difficult cash lending institutions frequently charge factors on your financing, sometimes referred to as origination charges. The factors cover the management prices of the lending.

Factors are commonly 2% to 3% of the finance quantity. Three factors on a $200,000 finance would certainly be 3%, or $6,000.

Not known Facts About Hard Money Georgia

You can expect to pay anywhere from $500 to $2,500 in underwriting costs. Some difficult cash loan providers also bill early repayment charges, as they make their cash off the rate of interest costs you pay them. That implies if you repay the funding early, you may have to pay an added fee, including to the car loan's price.This implies you're most likely to be used funding than if you looked for a typical mortgage with a doubtful or slim credit report background. If you need cash quickly for remodellings to turn a residence for profit, a difficult cash lending can provide you the cash you need without the trouble and also documentation of a conventional home loan.

It's an approach investors use to get financial investments such as rental residential properties without making use of a great deal of their own assets, as well as difficult money can be useful in these scenarios. Difficult money fundings can be beneficial for actual estate capitalists, they need to be utilized with care particularly if you're a novice to genuine estate investing.

With shorter payment terms, your regular monthly repayments will be much more expensive than with a regular home mortgage. Ultimately, if you back-pedal your financing settlements with a difficult money lender, the consequences can be extreme. Some fundings are personally guaranteed so it can harm your credit. And because the lending is safeguarded by the residential or commercial property concerned, the lending institution can occupy as well as foreclose on the building since it serves as security.

The Facts About Hard Money Georgia Revealed

To find a credible lender, speak with relied on realty agents or mortgage brokers. They may have the ability to refer you to lending institutions they have actually worked with in look at more info the past. Difficult money lending institutions additionally often go to investor meetings to ensure that can be a great area to attach with lenders near you.Equity is the value of the home minus what you still owe on the home mortgage. Like tough cash loans, home equity lendings are secured financial obligation, which implies your residential property offers as security. The underwriting for home equity lendings also takes your credit rating background and also earnings into account so they tend to have reduced rate of interest rates and longer settlement durations.

When it concerns moneying their following deal, investor and business owners are privy to several offering choices virtually produced real estate. Each features certain needs to gain access to, and also if utilized properly, can be of significant benefit to capitalists. One of these borrowing types is tough money loaning.

It can likewise be described an asset-based financing or a STABBL lending (short-term asset-backed bridge car loan) or a bridge finance. These are acquired from its particular temporary nature and also the demand for substantial, physical security, normally in the type of genuine estate residential property.

How Hard Money Georgia can Save You Time, Stress, and Money.

In the very same capillary, the non-conforming nature manages the loan providers an opportunity to select their very own specific demands. Because of this, demands might vary substantially from lending institution to loan provider. If you are looking for a lending for the very first time, the authorization process might be reasonably stringent as well as you might be called for to provide extra details.

This is why they are generally accessed by property business owners who would generally need fast funding in order to not read this post here lose out on warm possibilities. Furthermore, the lending institution mainly considers the value of the asset or home to be bought instead of the debtor's individual financing history such as credit history or earnings.

A traditional or small business loan might use up to 45 days to close while a hard cash loan can be enclosed 7 to 10 days, occasionally earlier. The comfort as well as speed that hard cash loans supply remain a major driving force for why actual estate capitalists pick to utilize them.

Report this wiki page